Have a story idea

Have a story idea? Send it to us here.

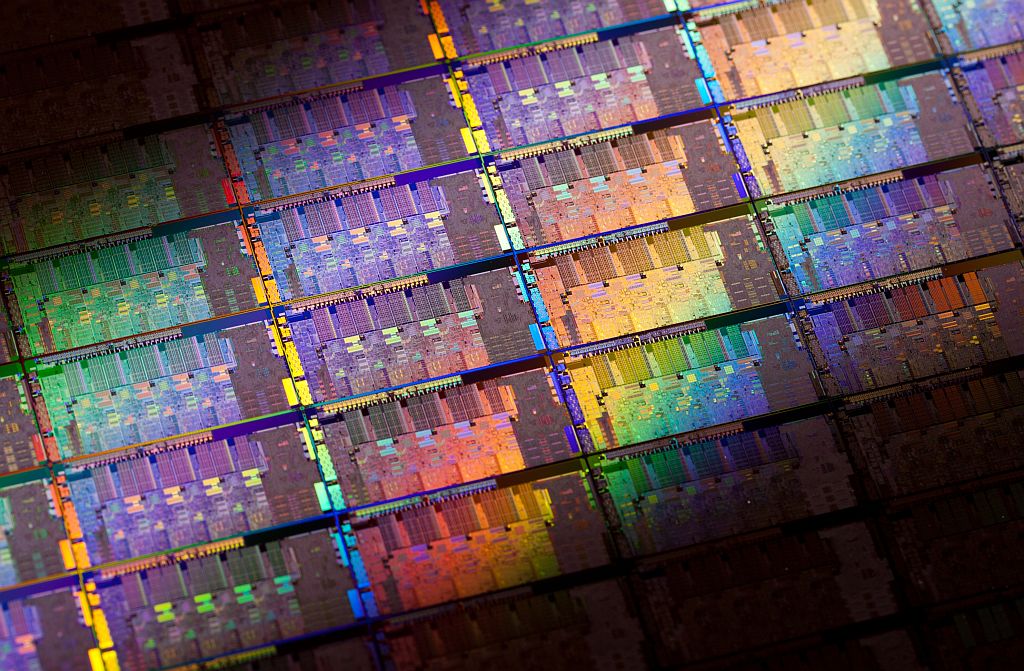

Source : Wikimedia

August 19, 2024

Author : Patty Allen and Alex Bustillos

As America prepares for the next Presidential election in November, it's important to reflect on the push by the federal government to encourage more investment in domestic hi-tech production over recent years.

According to an investigation by the Financial Times, many of the major U.S. manufacturing investments spurred by President Joe Biden’s industrial and climate policies are facing delays. Around 40% of the largest investments announced in the first year of the Inflation Reduction Act (IRA) and the Chips and Science Act have been either delayed or paused.

These two landmark acts, designed to promote the development of a U.S.-based cleantech and semiconductor supply chain, have offered over $400 billion in tax credits, loans, and grants. Despite this, projects worth a combined $84 billion, each valued at over $100 million, have experienced delays ranging from two months to several years or paused indefinitely.

A total of 114 large projects, valued at $227.9 billion, were tracked by the investigation. Companies cited deteriorating market conditions, slowing demand, and uncertainty around policy, particularly in the context of an upcoming high-stakes election year, as reasons for revising their plans.

Alex Jacquez, special assistant to the president for economic development and industrial strategy, defended the administration’s progress, stating there has been “unmitigated new success” in boosting construction and manufacturing. “Of course, we want to see these projects get up and moving as fast as possible. We continue to work to clear barriers related to permitting and financing where they exist,” Jacquez added.

Among the largest projects on hold are Enel’s $1 billion solar panel factory in Oklahoma, LG Energy Solution’s $2.3 billion battery storage facility in Arizona, and Albemarle’s $1.3 billion lithium refinery in South Carolina. Additionally, Pallidus’ $443 million semiconductor facility in South Carolina, expected to create over 400 jobs, remains inactive despite plans to start operations in the third quarter of 2023.

The delays are not limited to the cleantech and semiconductor sectors. Taiwan Semiconductor Manufacturing Company has postponed production at its $40 billion second fabrication plant in Arizona by two years. This delay has also affected suppliers in the area, such as Chang Chun Group, which has delayed its $300 million factory by two years, and KPCT Advanced Chemicals, which has put its $200 million facility on hold.

The sluggish rollout of government funding for semiconductor projects under the Chips Act and uncertainty surrounding IRA rules are contributing to the standstill. Nel Hydrogen paused its $400 million factory project in Michigan due to uncertainty surrounding tax credit rules, and Anovion delayed its $800 million factory in Georgia over unclear electric vehicle regulations.

The potential election of Donald Trump in November is adding further uncertainty. VSK Energy, a solar manufacturer, has delayed a $1.25 billion project and is considering moving operations to a Republican-leaning state to protect against a potential Trump administration.

Another thorn in the side of the success of Biden’s plan to create America as a leader in cleantech is China. China has dominated this market for years, producing more than 75% of the global solar panels, batteries, and semiconductors. This has delayed many manufacturers from starting production in American factories as the prices fell drastically due to overproduction.

We recently reported on how the United States and China are in an infrastructure race, investing massive sums into roadwork and more advanced forms of transportation.

Despite these challenges, the US has seen over $898 billion in private manufacturing investment since the passage of the IRA and Chips Act, with the White House touting growth across sectors such as biotechnology, chip fabrication, electric vehicles, and clean energy.

Category : Efficiency-Improving Technology Entrepreneurialism Federal Government Green Economy International Investment in Infrastructure Market Watch Public-Private Partnership Tech