Have a story idea

Have a story idea? Send it to us here.

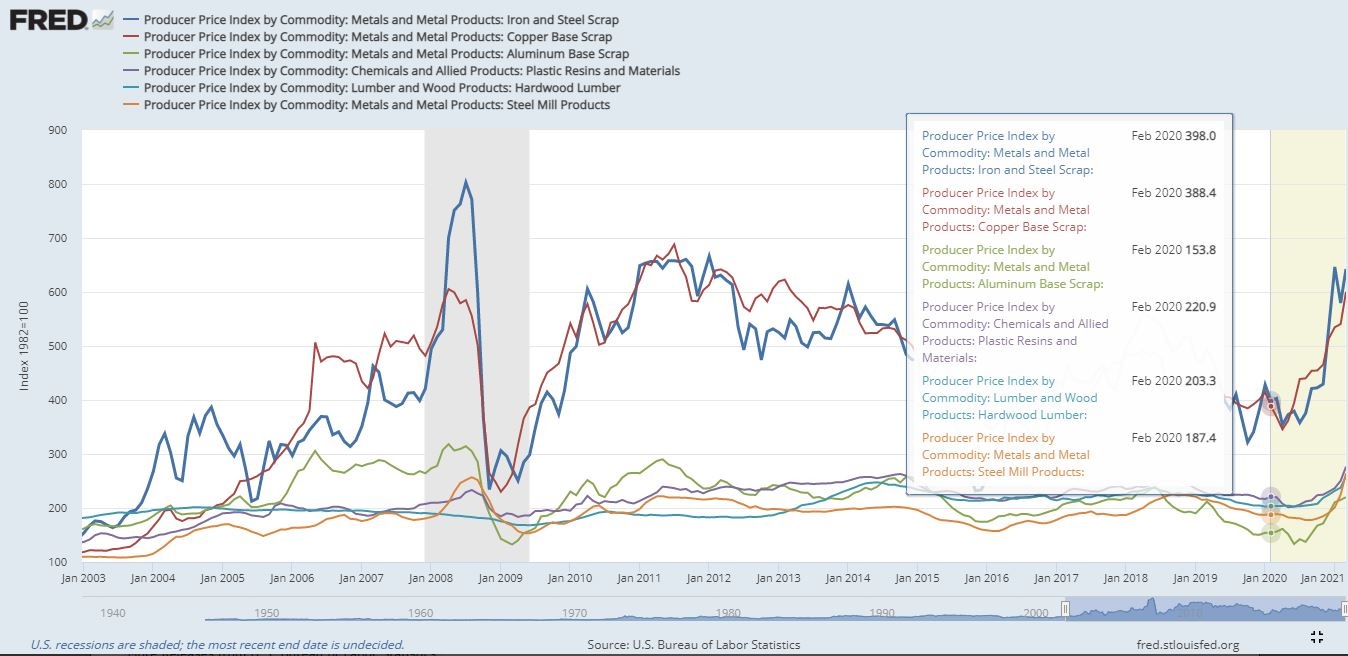

Source : Federal Reserve Economic Data

April 20, 2021

Author : Alex Bustillos

At Contractor News, we looked at tools available through the Federal Reserve Economic Data (FRED), an economic database from the Federal Reserve Bank of St. Louis, for price changes of key commodities for the construction industry.

We found that iron and steel scrap, copper base scrap, aluminum scrap, plastic resins, hardwood lumber and steel mill products have all seen their prices rise sharply in correlation with the coronavirus pandemic.

Scrap metals are used extensively in construction including roads and bridges and building materials, piping, wiring, roofing sheet, and more. Steel mill products are also used all the time: ingots, slabs, blooms, sheets, and more. Plastic resins are used to make panels, exterior coverings, weather boardings, windows, ceilings, floors, doors, partitions, piping, roofing and more. Just about every stage of home construction uses plastics in some way or another

The uses of hardwood lumber in construction go without saying.

According to FRED’s data, back in February of 2020, the price index of all these products were as follows: iron and steel scrap: $398; copper base scrap: $388.4; aluminum base scrap: $153.8; plastic resins and materials: $220.9; hardwood lumber: $203.3; steel mill products: $187.4.

As of February of 2021, those values changes to the following: iron and steel scrap: $579.8; copper base scrap: $540.7; aluminum base scrap: $215.1; plastic resins and materials: $250.5; hardwood lumber: $237.7; steel mill products: $224.8.

These value changes represent huge percentage increases. The price index of iron and steel scrap has increased by more than 45 percent; copper base scrap has increased 39 percent; aluminum base scrap has increased nearly 40 percent; plastic resins and materials have increased more than 13 percent; hardwood lumber has increased nearly 17 percent; and steel mill products have increased nearly 20 percent.

All this in one year.

While construction companies and contractors probably won’t be picking up the bill on these price increases, they are likely decreasing demand in new projects because of the bigger price tags, which ultimately hurts the construction industry.

All image graphs featured in this article were produced using FRED’s tools.

Category : Contractor Trades Coronavirus Pandemic Material Costs Modular & Prefabricated Construction