Have a story idea

Have a story idea? Send it to us here.

Source : Pixabay

May 26, 2022

Author : Alex Bustillos

If you work in the construction trades, you are well familiar with paving crews filling potholes or asphalting roads and parking lots.

Asphalt itself is obtained in part as a byproduct of petroleum distillation. This is important because when submitting quotes for a project, paving contractors and estimators must factor in the cost of all materials, with asphalt being a key component.

With rising petroleum costs and supply chain delays, determining one’s bottom line is becoming ever more difficult.

As a petroleum-based product, the cost of asphalt is directly linked to growing fuel prices. Over the last 10 years, the price of asphalt has risen 0.7% on average for every 1% increase in the price of crude oil. In recent days U.S. West Texas Intermediate (WTI) crude has hovered around $112 a barrel. By contrast, two years ago the price for a barrel of WTI crude was only $34.70.

Asphalt is regularly hovering between $7 and $13 per square foot. That’s more than double from just a few years ago, which is having a big impact on public works budgeting. One recent news report cites a county manager in Mississippi as explaining that the price of asphalt “went from $73 a ton last year to $123 this summer”.

A variety of technological tools do exist to help construction and paving firms with rising prices. For example, one recently developed app, by Brian Lawrence, President, and CEO of Asphalt Unlimited, can help to forecast regional future liquid asphalt prices for up to 18 months.

The App makers explain that their tool is based on a unique algorithm, which uses the data from NYMEX to pull daily closing prices and generates an asphalt projection that reflects the coker values of Asphalt. It generated a correlation (r-value) of 0.988041 when backtested against 13 years of published coker levels.

The App generates retail (rack) projections customized to specific geographic areas in the 48 contiguous states of the USA. The prices are offered in ranges to indicate what would be a reasonable value to include in a bid. The software is built on a subscription model, and all annual customers are entitled to a private consultation with Lawrence. The user selects the period with the App's slider and then taps on the geographic region to anticipate a pricing range.

Lawrence explains, "The algorithm never predicted a value below the published value," and "forecasts in real-time based on a day's closing prices." Retiring as senior vice president of CW Matthews Contracting in Georgia, he also spent 13 years as the chief operating officer of Bright Star Energy (Liquid AsphaltPurchasing).

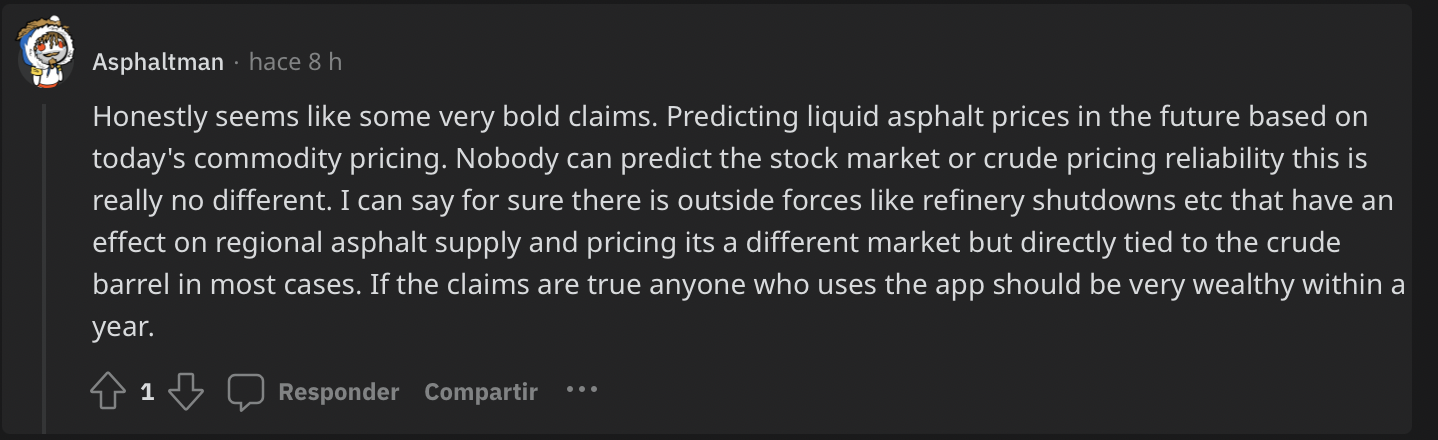

Discussion about the App on Reddit though has brought up some skepticism. One user called into question the ability of predicting crude pricing.

However, if you would like to give it a try, the App is available in both Android and iOS versions. The App makers, partnered with Unity Energy Partners, suggest they have created a sort of financial hedge to help protect business owners. "Contractors can put money in the fund, investing it with us, and we're managing it for them to help them cover prices every day," Lawrence says. "This is an investment that helps cover unanticipated costs."

Category : Contractor Trades Efficiency-Improving Technology Market Watch Material Costs Mobile Technology